Quantitative Trading The facts, Components & Analogy

Quant trade functions using habits which can be centered on mathematical values so you can determine the probability of a trading and investing benefit. As opposed to other exchange ways, quant change is situated only to your analytical tips coded to the logical algorithms. It requires advanced-top knowledge in the fund, math, and you can computer-programming to view quantitative exchange, as well as the race for a first job is going to be tough.

The other backtesting items include the method of getting historic info, deal will set you back inside it, and you can choosing a suitable backtesting means. Since the method is determined, one must collect historical details to execute analysis. Inspite of the large shell out level, certain quants whine that they’re “second-class people” to the Wall Road plus don’t order the fresh multimillion-dollar wages of top hedge money professionals otherwise money lenders. When you’re an investing bot is focus on independently, individual oversight continues to be necessary. Various other hurdle ‘s the fierce race certainly one of decimal traders, where actually slight advantages inside algorithm overall performance otherwise execution speed is also trigger significant development. So it competitive ecosystem may lead in order to ruthless and worry, as the investors have to continually innovate and adapt to stay ahead.

An upswing of high-frequency trading in the the new 100 years delivered more folks to your notion of quant, and also by 2009, 60% folks inventory investments was performed because of the higher-volume buyers, whom utilized mathematical habits. A performance method is a means to doing a set of positions for each exchange approach. The big matter when devising an execution experience the brand new software to the brokerage plus the mitigation from transaction will set you back. Very, an appropriate path would be to automate the new performance system from you to trading. Along with, it permits you to focus on search and you may focus on procedures away from large frequency.

Quantitative Exchange vs. Algorithmic Change

Once a keen outlier, they today said a seat at the table one of many premier financing, affecting everything from equity trade so you can around the world macro actions. Particular businesses employed PhDs inside the physics or math to develop systematic trading means, reading to possess small rates discrepancies otherwise designs https://bossistudio.com/11-best-change-apps-for-starters-2025-picks/ you to definitely repeated below certain standards. Antique managers ridiculed these “skyrocket researchers” for seeking to change an art on the a science. Important aspects were research top quality, model structure, business volatility, execution price, deal costs, and exactly how well the strategy adapts to help you switching requirements. The opposite from trend following, indicate reversion assumes on rates often go back to the average through the years.Whenever a valuable asset moves too far from its indicate, the brand new design bets for the a bounce. Occasionally, especially in higher-volume exchange (HFT), hosts create investments inside milliseconds, taking advantage of little speed change thousands of times daily.

For long-name people, it’s a way to get a blue-chip business for cheap. And for short-label traders, it’s a chance to get twice-hand growth by investing in one of the most boring enterprises on earth. Several years ago, we during the InvestorPlace and you may all of our partners in the TradeSmith first started taking care of AI-pushed using systems to bring Wall structure Street’s line so you can normal investors. This type of AI formulas crunched scores of analysis items and found associations anywhere between basic investigation and you can upcoming efficiency you to definitely zero typical people you’ll.

Create Quants Receives a commission Well?

High-regularity trade, specifically, relies heavily to the lower-latency infrastructure. Including co-venue functions in which trading organizations put their machine close up to change servers to minimize latency. At the same time, cutting-edge network possibilities and you may fibre optic contacts are used to be sure the fastest you’ll be able to research signal and you will purchase delivery.

Backtesting the techniques

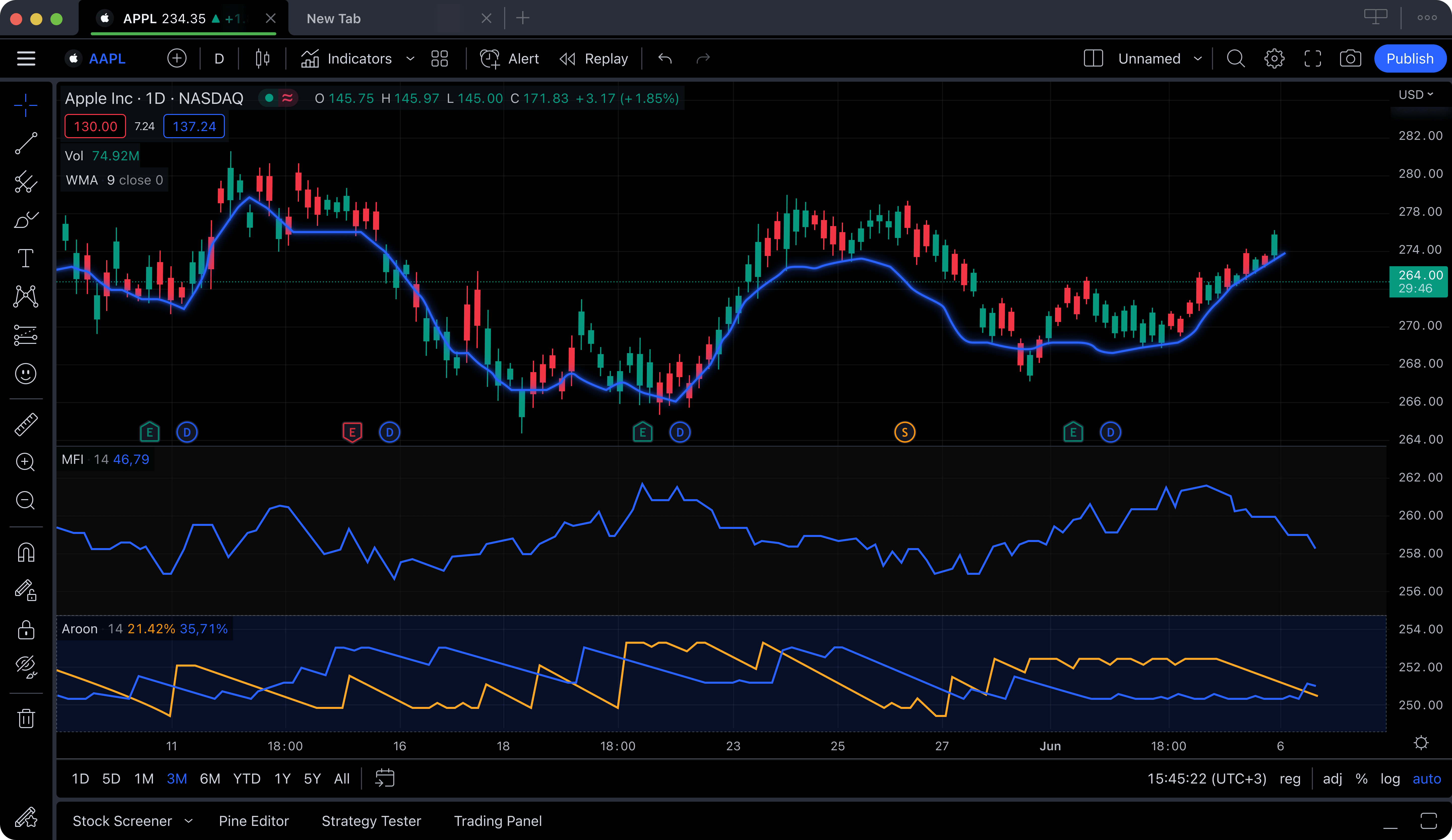

Such processes will get involve rapid-flame order delivery and you will routinely have brief-name financing horizons. Quantitative trading include change tips based on decimal analysis, and this trust statistical data and you will amount crunching to recognize trading options. Rate and you may frequency are two of one’s more prevalent investigation enters utilized in decimal analysis because the chief enters so you can mathematical designs. Currency pair arbitrage is actually a technique traders used to benefit from short-existed rates variations in the forex market. Like many algorithmic exchange tips, it utilizes small execution and you will solid exposure management to advance. Individual who aspires to be a great quant have to have at least record inside the money, computer programming, and you can mathematics.

It provides technology chance, for example machine co-found at the newest replace suddenly developing a challenging computer malfunction. It gives brokerage exposure, such as the broker becoming bankrupt (far less crazy because sounds, considering the recent frighten with MF Around the world!). Simply speaking they discusses nearly exactly what may indeed hinder the new exchange execution, where there are numerous source. Whole instructions try centered on risk administration to possess decimal actions so We wont’t you will need to elucidate on the all the you’ll be able to resources of chance here. The last big problem to possess execution options issues divergence of method results away from backtested performance. We have already chatted about search-to come prejudice and you can optimization prejudice in depth, when it comes to backtests.

Note that annualised return isn’t an assess usually utilised, as it doesn’t think about the volatility of your approach (as opposed to the brand new Sharpe Ratio). Various other greatly important aspect from quantitative trading is the frequency from the new change strategy. Reduced regularity trading (LFT) fundamentally refers to one approach and that holds assets more than an excellent change go out.

Master’s degrees inside the economic systems otherwise computational finance are productive entry points to have quant jobs. Quant investors is use numerous trading means, but we’ll bring a short consider a couple of in particular—high-volume trading and you will momentum trade. Of several brokerages and you may exchange organization today ensure it is clients to exchange via API in addition to old-fashioned platforms. It has permitted Doing it yourself quant traders to help you code their options you to definitely perform instantly. Some other wider category of quant strategy is development pursuing the, known as energy change. Pattern following the is one of the most simple actions, seeking in order to select a critical industry way since it starts and you may drive it up until they ends.