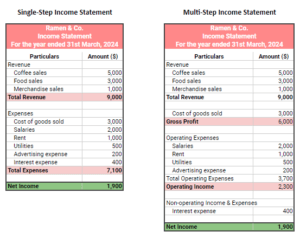

Multi-step Vs Single-step Income Assertion: Key Variations, Format, And Excel Examples

Revenue realized by way of main actions is also recognized as working revenue. For an organization manufacturing a product, or for a wholesaler, distributor, or retailer concerned in the https://www.personal-accounting.org/ enterprise of promoting that product, the income from major actions refers to income achieved from the sale of the product. Uncover the next technology of strategies and options to streamline, simplify, and transform finance operations. Fundamentally, the essential premise of either presentation format is conceptually the same, granted the outcome of either method is to arrive at net earnings. Shaun Conrad is a Certified Public Accountant and CPA exam professional with a ardour for instructing.

A small enterprise that has a simple working structure, similar to partnerships or sole proprietorships, may use either single-step or multi-step income statements. Main revenue and expenses supply insights into how properly the company’s core business is performing. Secondary income and costs, however, account for the company’s involvement and expertise in managing advert hoc, non-core activities.

At that stage, a multi-step income statement or even more complete monetary statements could additionally be necessary. There are a quantity of factors that help the necessity of knowing several methods of revenue statement presentation and their underlying foundations. First of all, the construction of the earnings statement can have an result on the accuracy and simplicity of the financial information shown, thereby influencing the tactic of financial concern decision.

Significance Of Understanding Completely Different Revenue Statement Formats In Financial Evaluation

Multi-step earnings statements break down income and bills into distinct categories, making it easier to see the place your company is making and losing cash. Single-step income statements, on the other hand, lump everything together into one bottom-line determine. In Canada, firms should adhere to the Worldwide Financial Reporting Standards (IFRS) as adopted by the Canadian Accounting Requirements Board (AcSB). While IFRS does not mandate a selected income statement format, it requires entities to current info that’s relevant and faithfully represents the company’s financial efficiency. However, as a enterprise grows or if it seeks external financing, it might want to offer more detailed monetary stories.

These metrics present priceless insights into how well a enterprise manages its manufacturing costs and operating expenses relative to its sales. Understanding gross revenue helps in pricing choices multiple step vs single step income statement and price management, whereas working income highlights the effectiveness of business operations. In the single-step earnings statement, calculating gross revenue would possibly appear to be a direct sail; however, this format doesn’t sometimes offer an itemized display of gross profit. As A Substitute, it combines all revenues and subtracts the whole bills and losses in one transfer, leading directly to net earnings or loss. This methodology makes the calculation less time-consuming however offers fewer financial particulars in regards to the primary enterprise activities that generate income. Multi-step revenue statements present a extra detailed image of a company’s financial scenario than single-step statements.

It is a key measure of the company’s operational efficiency and its ability to generate profits through its primary enterprise operations. Totally Different formats, primarily the single-step and multi-step earnings statements, present financial knowledge in distinct ways. Each format provides various ranges of detail and analytical depth, impacting the convenience of conducting trend evaluation, ratio evaluation, and sector comparisons.

Step 1: Calculate Gross Profit

It allows for an in depth analysis of how totally different enterprise segments carry out, contributing to strategic decision-making. Non-operating items are essential for understanding the full scope of a company’s financial actions and general profitability. They are accounted for in the revenue statement to provide a whole image of the company’s net income, illustrating how each operational and non-operational elements contribute to the company’s financial efficiency. The primary objective of an revenue assertion is to convey details of profitability and enterprise activities of the company to the stakeholders.

Still, it uses a quantity of equations to calculate the web revenue or yield of the corporate. Add the operating earnings to the web non-operating expenses and losses as properly as the gains and revenues to acquire the web income or loss. Single-step revenue statements compute web earnings with a single equation making them easier to make use of, and but they nonetheless allow a enterprise to see its income or losses. However, real-world companies often function on a world scale, have diversified business segments providing a combine of services, and incessantly get entangled in mergers, acquisitions, and strategic partnerships. The above example is the only type of revenue assertion that any normal enterprise can generate. It is called the single-step income statement as it’s primarily based on a easy calculation that sums up revenue and positive aspects and subtracts bills and losses.

In conclusion, the choice of an revenue assertion format is not merely a matter of accounting desire however a strategic decision that may influence the complete monetary panorama of a company. In summary, choosing the right revenue assertion format is determined by the business’s dimension, business norms, and stakeholder necessities. The single-step earnings assertion presents a straightforward accounting of the financial exercise of your business. Then, we incorporate different revenues and expenses to provide you with the earnings to be subjected to tax. The four key parts in an revenue assertion are income, positive aspects, bills, and losses. While the balance sheet provides a snapshot of a company’s financials as of a selected date, the revenue assertion reviews income through a specific interval, normally 1 / 4 or a 12 months.

- Every fashion has advantages and drawbacks; the objectives of the corporate and diploma of complexity will information its selection of the finest one.

- A single-step earnings assertion provides a simple accounting technique for the financial exercise of a business, making it simple to arrange and perceive.

- The best choice for a given company is determined by the kind of enterprise it is and what it intends to use the income statement for.

- It provides insights into the enterprise’s capacity to generate profits from its main activities, thus serving as a key metric for assessing operational effectivity.

- This separates revenues and expenses which might be instantly associated to the business’s operations from those that aren’t immediately tied to its operations.

This format can also be most well-liked when presenting monetary statements to exterior stakeholders corresponding to banks, investors, or potential companions. Detailed stories build confidence in the company’s monetary administration and might facilitate funding or funding alternatives. The multi-step income statement provides several benefits over the single-step format, primarily as a outcome of its detailed construction.

Small businesses with more complicated operations, multiple income streams, or a need to offer detailed monetary info to buyers or lenders typically profit from utilizing a multi-step revenue assertion. In the vast ocean of financial reporting, crafting a single-step income statement is akin to navigating with an easy compass. This easier technique provides a transparent however broad view of a company’s financial health, making it an accessible option for so much of small businesses. Whereas they are much less comprehensive than multi-step earnings statements, in some circumstances they can provide all the major points you may need to assess the financial well being of a enterprise. The parts of the multi-step earnings statement comprise three equations that calculate a profit metric that every measures a novel attribute of the underlying company’s monetary efficiency. A multi-step earnings assertion offers the primary points of the working bills and operating revenues in addition to the non-operating bills and revenues.